The EU may have enough juice to keep its own members in line, but it is powerless against the will of U.S. liquefied natural gas (LNG) producers.

Europe currently has its stockpiles full to the brim with either Russian leftovers or regasified U.S. LNG. Those are its two options for the next few years.

Unless EU leaders are concocting some last-ditch effort to force Putin into a change of heart, I’d say the U.S. is Europe’s best chance at keeping energy flowing into 2023 and beyond.

My heart goes out to the citizens being gouged thanks to a conflict they had no part in starting. But U.S. LNG producers are unlikely to feel the same way.

The EU is currently voting on a price cap for natural gas. It would limit the cost to €180 ($191) per megawatt hour if prices continue to soar out of control.

From a citizen's perspective, that’s fantastic news. Some countries in the bloc were paying upward of five times their usual bulk rate.

But for the producers who are obligated only to the almighty dollar, that price cap is to be avoided like the plague.

Stealing From Tomorrow to Pay for Today

Short-term solutions seem to be Europe’s only interest. Perhaps some countries are confident that the fighting will be over soon and Russia will open its taps again.

I’m sure many of them thought that nine months ago, back when this supposed “special military action” was expected to end in just weeks.

The truth is Russian gas supplies stand a very real chance of never returning to Europe. If Putin continues to control the country, I don’t expect him to forgive and forget so soon.

U.S. LNG is the only short-term option that makes sense. Anything else won’t be ready for years at minimum.

And since Russia is still dishing out oil and gas at exorbitant prices to Asian countries, the market for U.S. LNG is worldwide. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

If Europe decides it doesn't want to pay the market rate for LNG, producers will simply take their incredibly flexible fleets of LNG delivery vehicles and sail them to a better port.

Again, I can’t argue with the decision that much. The EU is just trying to protect consumers from the insane price surges caused by Russia departing.

But considering those leaders might be the exact same ones who got their countries hooked on Russian gas in the first place, I don’t feel sorry for them.

And if they think prices are bad now, wait until they scare away U.S. deliveries by trying to sloppily fix their nations’ own mistakes.

Setting a price ceiling like this without implementing any hard-core demand-control measures is just asking for trouble.

It’s a recipe for nationwide blackouts. Not only will the U.S. be taking its services elsewhere, but no European country will have the bargaining power to secure outside supply. All competitors would need to do is beat out €180.

That shouldn't be too tough when half the planet is hard up for energy.

You Hate to See It, But…

At the risk of sounding insensitive, this is an unbelievable profit opportunity disguised as a crisis.

Competition over U.S. LNG has sent prices to absurd heights. Europe managed to beat most of its competitors, but that won't last long.

Soon, buyers from all over the world will be digging deep to get their own deliveries. Europe will either be forced to backtrack its decision or get left behind.

For the U.S. companies that are expanding like mad, that’s the best possible news.

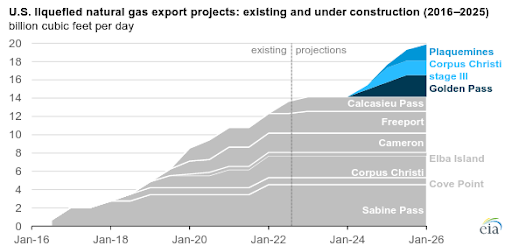

Production capacity in the U.S. is set to expand from 11.1 billion cubic feet per day (Bcf/d) to 20 Bcf/d by the end of 2025.

That means even if Europe abandons its price cap, the U.S. will still have more than enough to spread around.

It’s a bull run with a practically guaranteed five-year runway. I can’t imagine a better sign to invest in U.S LNG.

Our team has been following this market for years now — decades, even. We’ve seen moments like this before, and we know exactly where the biggest profit opportunities lie.

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital